Can I afford to totally change my life?

Learn more about sponsor message choices: podcastchoices.com/adchoices

NPR Privacy Policy

Explore "financial well-being" with insightful episodes like "Can I afford to totally change my life?", "Why it’s important to talk about money, with Wendy De La Rosa, PhD", "Tesla’s Competition", "How To Prepare For The GLOBAL RECESSION & Build Wealth In The Process! | Raoul Pal" and "Where You Should Live When You Could Live Anywhere" from podcasts like ""Life Kit", "Speaking of Psychology", "Motley Fool Money", "Impact Theory with Tom Bilyeu" and "The Art of Manliness"" and more!

We’ve all heard the advice: Save for retirement, start saving early, don’t spend more than you earn. But rules like these are far easier said than followed, especially when you’re short on time, or money, or both. Wendy De La Rosa, PhD, of The Wharton School at the University of Pennsylvania, talks about why it’s so hard to take financial action, how financial stress affects us and our relationships, and why we need to get rid of ‘financial shame’ and talk more openly about money.

For transcripts, links and more information, please visit the Speaking of Psychology Homepage.

When we think about people who can live anywhere, we tend to think about corporate-employed remote workers and online entrepreneurs. But many other kinds of professionals, from teachers to doctors, could hypothetically find a job anywhere, and thus live anywhere they’d like.

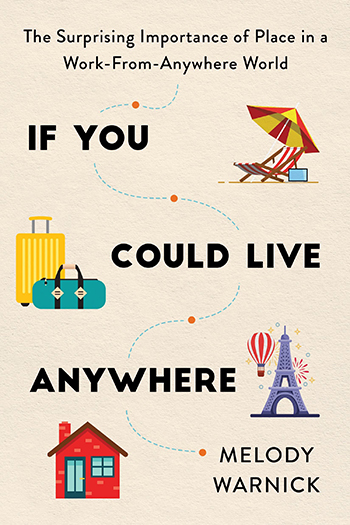

If you’re what my guest Melody Warnick calls an “anywhereist” and have seriously or casually considered moving somewhere else, today we’ll talk through the factors to consider in making that decision. Melody is the author of If You Could Live Anywhere: The Surprising Importance of Place in a Work-from-Anywhere World, and in today’s conversation we discuss the factors that you should include in what she calls a “location strategy,” from the cost of living in a place to whether it allows you to build the kinds of relationships you’re looking for. We also talk about how the place you live can be part of your purpose in life and the elements that contribute to an overall quality of life.

In this episode, Patrick was joined by Adam Sosnick and Tom Ellsworth to discuss Disney Plus, Musk tweets, Student Loan Debt, and much more.

Here's the link to watch the full episode: https://youtu.be/s86iliiBbXE

--- Support this podcast: https://podcasters.spotify.com/pod/show/pbdpodcast/support

The shutdowns that have accompanied the COVID-19 pandemic have wreaked havoc on the global economy. Millions of people are out of work, businesses are cratering, and the stock market has tanked. Whether you've been hard hit by these effects or are so far weathering the storm yet feel uncertain about your future, what financial moves should you be making right now? To get some insight, I brought back personal finance expert Ramit Sethi, author of the book I Will Teach You To Be Rich. Since the pandemic started, Ramit has been hosting "fireside chats" on his Instagram account where he covers a financial topic pertinent to the pandemic, as well as answers questions from his community of followers.

Today we discuss some of the ideas Ramit's been hitting on during these chats as well as the common financial questions he's been fielding. I begin our conversation by asking Ramit why he tells people they shouldn't panic, but should overreact. We then dig into Ramit's advice for people who fall into different categories as to how the pandemic has affected them, beginning with survival strategies for those who are out of a job altogether. Ramit then shares the money moves people who do still have income coming in should make and why he's changed his tune on how much of an emergency fund you should have. We then discuss why now is a good time to find ways to earn more money and what investing should look like during an economic slump. We end our conversation with Ramit's advice on how to look for a job during a pandemic and what small businesses can do to adapt to the current climate.

Get the show notes at aom.is/pandemicfinances.

Hosted on Acast. See acast.com/privacy for more information.

Stay up to date

For any inquiries, please email us at hello@podcastworld.io